A Weekend Retirement Portfolio for the Trump-Revenant Era

Tagged:Investing

/

Retirement

/

Statistics

In the wake of a revenant Trump and the resulting generally deranged policies, we’ve decided to alter our retirement investments.

The Ground Rules Have Not Changed

Previously, in mid-2021 we showed our retirement portfolio and its rationalization. The idea was to make a portfolio of index funds that we could hold pretty much indefinitely.

The ground rules were:

- Use diversified mutual funds or ETFs, never try to pick stocks or bonds yourself.

- Always use index funds. Active management is of negative value.

- Use cheap index funds, i.e., low expense ratios. In the past this meant Vanguard, though there is some competition now. Vanguard is basically organized as a non-profit, unlike everybody else. I’ve been using Vanguard since about 1979 and like them.

- Use sensible asset classes: US total stock market index, foreign total stock market index, REIT index, Treasury/TIPS index of short-intermediate term, tilts to small and value stocks, and foreign bond index. [1]

Peter Bernstein wrote a famous article in 2002 about the virtues of a 60% stock / 40% bond portfolio. [2] While I won’t go so far as he did and recommend it to everybody all the time, it’s nonetheless what I probably want in early retirement.

We want to maintain international diversification too. The US is about 55% of the world stock market, so an unbiased portfolio would have a US/foreign ratio of 55/45. We achieve that partly through using VTWAX, the world stock index fund, equivalent to the ETF VT.

We also want to diversify across the value and size factors, so we include tilts in the stock portion to REITs (value-ish), US small value stocks, and foreign small stocks.

The Risks Have Changed

That’s pretty much where we still are: index funds, broadly diversified over investment instruments (stocks/bonds/real estate), capitalizations (large/small), valuations (growth/value), and nations.

So why change?

Because the risks have changed drastically!

Our portfolio was perfectly adequate for a very wide variety of circumstances. But the present circumstances are driven by Republican lunatics, pursuing self-destructive policies of personal revenge and venomous racism. Clearly, we need to be more defensive, at the very least!

However, we’ll try to keep in mind a dictum of Jack Bogle on the subject of adjusting asset allocation to respond to the world: “If you must sin, then sin just a little.” [3] So we’ll adjust our asset allocation in the correct direction, but not drastically.

By “in the correct direction”, we mean:

- Slightly less emphasis on stocks, as in a lower stock/bond ratio.

- Slightly less emphasis on the United States, as in both:

- more foreign stocks, and

- more foreign bonds (with a currency hedge applied to the bonds, as per above).

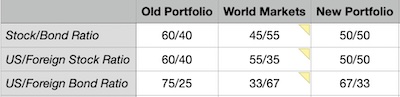

For comparison, here are the ratios for our old portfolio, world markets, and our new

portfolio.

For comparison, here are the ratios for our old portfolio, world markets, and our new

portfolio.

- In the first row, we’ve gone from a very conventional 60/40 stock/bond ratio to a slightly more conservative 50/50 ratio. It’s still not as conservative as world capital markets, which according to MSCI [4], are dominated by bonds at 45/55. So even our new defensive position is more aggressive than world markets as a whole.

- In the second row, we’ve gone from a 60/40 US/foreign stock ratio to a rather more international 50/50 ratio. The world market position, according to Morningstar [5], is about 55/45. So we’ve gone from stocks with a slight tilt toward the US to stocks with a slight tilt away from the US.

- The third row shows we’ve increased our foreign hedged bond allocation from about 25% of bonds to about 33% of bonds. According to Vanguard [6], the world markets are even more aggressively weighted to foreign bonds at about 67%.

So we’re making some changes, both away from stocks and away from the US. But they’re not drastic changes, in accordance with Bogle’s dictum above.

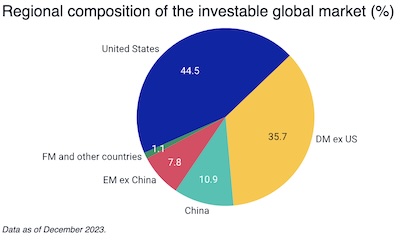

Still, there’s plenty of room to go further. The pie chart shown here, from the same MSCI

source, shows the world investable portfolio (stocks/bonds/real estate that trade in a

reasonably liquid fashion), broken down by region at the end of 2023. If we were to take

our market indexing principles very seriously, we might conclude that

no more than 45% of assets should be invested in the US.

Still, there’s plenty of room to go further. The pie chart shown here, from the same MSCI

source, shows the world investable portfolio (stocks/bonds/real estate that trade in a

reasonably liquid fashion), broken down by region at the end of 2023. If we were to take

our market indexing principles very seriously, we might conclude that

no more than 45% of assets should be invested in the US.

We are, however, willing to invoke pragmatism: we live in the US, we earn in the US, we pay taxes in the US, and we spend in the US. A small amount of home market bias is excusable.

What’s not excusable is letting home market bias bind us to unique home market risks imposed by Republicans. We’re getting slightly more defensive because of that.

The Results

Here’s what the old portfolio looked like. We’ve held something very close to this since

around 2020 (before that, during the accumulation years we held a similar but more

aggressive version with less bonds):

Here’s what the old portfolio looked like. We’ve held something very close to this since

around 2020 (before that, during the accumulation years we held a similar but more

aggressive version with less bonds):

- 60/40 stock/bond ratio

- 60/40 US/foreign stock ratio

- 60/40 total market/small-value tilts ratio

- 75/25 US/foreign bond ratio.

In terms of tax placement, the old portfolio was less in the tax-free Roth compartment than you’ll see

below with the new portfolio. This is due to 2 factors:

In terms of tax placement, the old portfolio was less in the tax-free Roth compartment than you’ll see

below with the new portfolio. This is due to 2 factors:

- Relentless annual partial Roth conversions, in which we’re gradually converting to a portfolio that will be largely immune to future tax rate changes (or at least reasonably diversified in that respect).

- The Trad IRA (tax deferred) is mostly bonds, while the Roth IRA (tax free) is mostly stocks. We expected, and got, more growth in stocks than bonds. So the Roth compartment grew quite a bit in comparison to the Trad compartment.

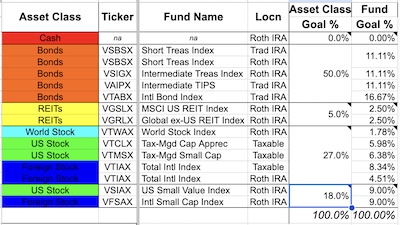

Here’s what our revised portfolio looks like

for comparison with our previous portfolio design:

Here’s what our revised portfolio looks like

for comparison with our previous portfolio design:

- The first column is the asset class, with colors going up the spectrum with risk from cash to stocks.

- The second and third columns are the mutual fund names, both by ticker symbol and a

short description of the asset class.

- All are index funds except for VAIPX, the intermediate TIPS fund. It’s technically active, but they way Vanguard runs it with low expenses, low turnover, and just covering the asset class it might as well be an index fund. Honestly, I don’t know why it’s not an index fund, other than just history.

- The fourth column gives the tax placement, either:

- a regular taxable account (taxed at capital gains rates upon sales), or

- a tax-deferred Trad IRA (taxed as ordinary income upon withdrawal), or

- a tax-free Roth IRA (taxes already paid, never to be taxed again). Obviously this category is very desirable, and we’ve been doing (a) annual conversions, and (b) putting the most high-growth assets in this account.

- The fifth and sixth column give the asset allocation in terms of general investment class, and sub-asset allocation in terms of individual mutual funds.

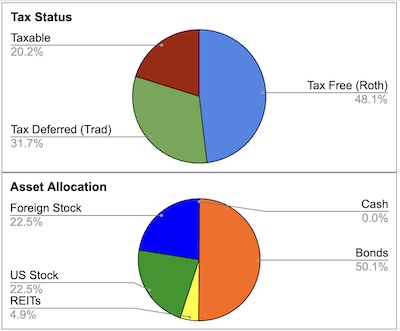

The pie charts show some of the same information, but in graphical form:

The pie charts show some of the same information, but in graphical form:

- Our tax placement is getting increasingly favorable, with almost 50% of assets now completely shielded from taxes in the Roth account. The idea is to keep doing this up until the age of Required Minimum Distributions (RMDs) from the Trad account, so we won’t be forced to recognize too much taxable income when that happens.

- Obviously we have a 50/50 stock/bond ratio, and a 50/50 US/foreign stock ratio. (The US/foreign bond ratio does not appear in this plot; perhaps it should?)

The US/foreign real estate allocation (REITs) are obviously 50/50 US/foreign. Also, the “tilt” funds to US small value and foreign small are obviously 50/50.

In order to verify the US/foreign stock ratio of the cap-weighted funds, some extra information is required:

- VTCLX and VTMSX are 100% US stocks, 0% foreign.

- VTIAX is 0% US stocks, 100% foreign stocks.

- VTWAX is (as of 2024-Dec-31) 63.58% US stocks, 36.42% foreign stocks.

So the domestic and foreign stock allocations are:

{VTCLX+VTMSX+0.6358⋅VTWAX=5.98%+6.38%+0.6358⋅1.78%=13.492%VITIAX1+VTIAX2+0.3642⋅VTWAX=8.34%+4.51%+0.3642⋅1.78%=13.498%Since those are substantially equal, our US/foreign allocation is indeed what we think it is at a 50/50 split.

The Weekend Conclusion

This is not investment advice; it’s just a summary of what we’re doing here at Château Weekend.

The world is terrible. But as all the existentialists have said, “Nevertheless, here we are.” We have to cope with what is in front of us.

For investments, that means becoming somewhat more defensive. Politically & practically, it means becoming as difficult as possible, throwing sand in all the gears of Republican fascism.

At my age, I can do the former, but will have to choose carefully about the latter.

As must we all.

(Ceterum censeo, Trump incarcerandam esse.)

Notes & References

1: Vanguard’s foreign bond index fund VTABX is currency-hedged back to the dollar, so it has no currency risk. It’s largely sovereign bonds of developed nations, so it looks like Treasuries. Vanguard always recommends it.

The last time I looked, Vanguard’s evidence said it wouldn’t help diversification much… but wouldn’t hurt either. (See here, Figure 7 on p.10: note the broad, shallow “optimum” where the portfolio variance changes by only 0.2% as the foreign bond allocation goes from 0% to 100%!) So I decided to take Vanguard’s advice. ↩

2: PL Bernstein, “The 60/40 Solution”, Bloomberg Personal Finance, 2002-Jan-Feb. Retrieved via the Wayback Machine 2021-Jun-19.↩

3: I’ve been unable to source this quote adequately! Something similar appears in a paper by Arnott & Asness, but I’m pretty sure Bogle is the original source. Anybody got a pointer? ↩

4: M Szikszai, K Crouch, “Sizing Up the Global-Market Portfolio”, Morgan-Stanley Capital International, 2025-Nov-04.

See the first table for the fraction of global assets in fixed income; see the pie chart for the US share of the global investable portfolio. ↩

5: AC Arnott, “How to Use International Stocks in Your Portfolio”, Morningstar, 2024-Sep-16. ↩

6: Vanguard Research Staff, “Global fixed income: Considerations for U.S. investors”, 2012-Mar. NB: Archived on this blog for reference. This is the paper justifying (slightly) the use of hedged foreign bonds in the portfolios of ordinary investors. ↩

Gestae Commentaria

Comments for this post are closed pending repair of the comment system, but the Email/Twitter/Mastodon icons at page-top always work.